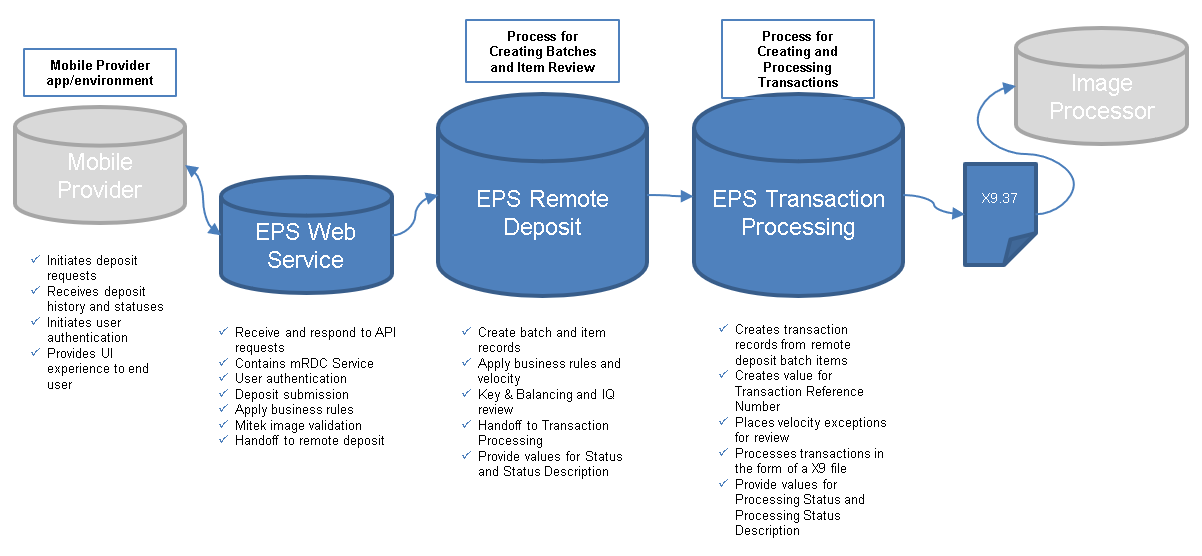

Remote Deposit Life Cycle

There are two different processing engines to be aware of that affect each deposit made through the mRDC web service. They are called Remote Deposit and Transaction Processing. It is beneficial to understand their function in order to know what to expect on each deposit, and understand the meaning of the different statuses being returned in the web service. The below diagram illustrates the relationship between the two processing engines and where they fit into the overall process.

EPS Remote Deposit

This is the first engine in the process behind the web service and is primarily responsible for handling batches and several other key actions.

- New deposit batch and item records are created here as received from the web service for processing.

- Different business rules are applied such as velocity, and if there are exceptions, they will be flagged accordingly.

- Batches and items are reviewed by Keying and Balancing where corrections and or rejections may occur as needed.

- Each batch and item record will be updated with statuses accordingly throughout the process. The statuses that are applied by the remote deposit engine are labelled as “Status” and “Status Description” in the web service responses. See the “Statuses” section below for status definitions.

There are several factors that determine how quickly items move through the remote deposit process. If an item is not flagged for further review in Keying and Balancing, items will generally move through in several seconds. If items are flagged for further review (which could include issues with image quality, amount, MICR, or balancing), it may take several minutes to up to an hour depending on the current workload in the Keying and Balancing queue at that time. Once all remote deposit process steps are complete, items are handed off to Transaction Processing for further processing.

EPS Transaction Processing

This engine takes place after remote deposit and is primarily responsible handling transactions and several other key actions.

- When items are received from remote deposit, Transaction processing creates transactions from those items. This is when a transaction reference number will be generated.

- If any velocity exceptions resulted in a suspended status, those transactions will be placed in a review queue where they will wait to be manually reviewed.

- Each transaction will be updated with statuses accordingly throughout the process. The statuses that are applied by the Transaction Processing engine are labelled as “Processing Status” and “Processing Status Description” in the web service responses. See the “Statuses” section below for status definitions.

- At the specified cutoff time, transactions will be processed into an X9 file for delivery. Delivery method of the file is dependent upon options chosen during implementation.

Keying and Balancing

Our Item Processing team provides Keying & Balancing services for our mRDC product that happens during the Remote Deposit Process shown above. The essential function is to ensure deposits are processed accurately when items are flagged as needing attention. The following is a closer look at each aspect comprised of Keying and Balancing.

MICR Repair – When an item is flagged for MICR review it enters the MICR queue. In this queue Item Processors review and key the Routing and Account number displayed on the bottom of the check. Using their best judgement some items are rejected due to factors in which we are unable to process the item

Amount Keying (CAR) – For instances in which the courtesy amount (CAR) on an item is unreadable or determined as needing review, checks will enter this queue. Item Processors review the numerical CAR amount on the check and key this amount.

IQUA Review (Image Quality & Usability Assurance) – Some items are flagged as having an image quality issue, these are sent to the IQUA queue for review. In this queue, Item Processors review checks for image quality issues that could interfere with processing. If an item is unreadable, the Item Processor will mark the image as rejected.

Balancing – When a batch of items submitted by a merchant does not match the control totals that were provided, the deposit is sent to the Balancing queue for review by an Item Processor. In this queue, an item processor will carefully review each item individually to ensure that each check is keyed for the written legal line amount. The goal of the Balancing queue is to correctly balance deposits to the control totals (sum of item amounts entered by the user), when incorrect control totals are provided item processors submit the deposit with an adjustment.

Open batches and the EPS automated reject process

EPS has an automated reject process that runs nightly on our remote deposit database and happens during the Remote Deposit process shown above. Any batches that are left in an open for scanning status as a result of the user not closing the deposit to submit for processing for a period of 30 days, will be considered abandoned and automatically rejected by the system. If reject email notifications are setup for the merchant, those notifications will be sent when the batch is auto rejected.